Have you ever heard that a tax deduction was possible when you have private credit. What is it really and how is the taxation of private credit in Switzerland? Small zoom on the subject in order to learn more about it and especially to make you save taxes when possible!

The possibility of obtaining a tax deduction for your private credit

Taking out a loan reduces the amount of your taxes. This, on condition of knowing how to declare it to the taxes to benefit from the best possible tax advantages. So what is it possible to deduct when you have a private debt?

Having a current credit agreement means that you are on a commitment to repay a fixed amount over a period of time. This amount in question is made up of the following 2 elements:

- the amount you borrowed and need to pay back (the amortization);

- the interest generated by this loan.

You can already note that this interest is deductible from your taxes, provided you add it to your tax return. The interest generated by your loan will indeed reduce your income. This therefore has the effect of reducing your taxable income and making you pay less tax.

After interest, deduct the amount of his debt

Indeed, deducting the interest paid from your credit will allow you to reduce your income and deduct the amount of your debt, will reduce the amount of your fortune.

Less income and less wealth = less tax!

Here is how to declare your credit in the “VaudTax” software, which is valid for taxpayers taxed in the canton of Vaud.

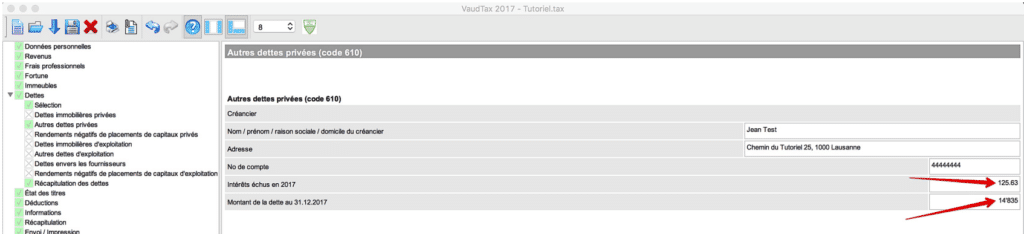

In the “Debt” section, complete the information requested by the software in the “Other private debts” tab. Here is a screenshot that shows you a concrete example of a declaration.

According to the VaudTax system, all you need to do is complete the following information to benefit from your tax savings in relation to your loans.

- name of creditor (the bank, institution or lender to whom you owe money);

- address of the creditor;

- account or contract number;

- total interest paid over the relevant period;

- amount of debt at 12.31.

Once this information has been completed, the software will automatically take care of making the correct deductions from your income and your wealth.

Know the amount of annual interest you are paying

Do you want to know everything about your private credit taxation? Start by finding out about the total amount of your interest for the year. Depending on the bank or the creditor, some credit agreements do not always necessarily mention the breakdown between interest and repayment. Read your contract carefully and don't hesitate to Contact us if you need help.

Note, however, that during the first period of the year, that is to say between January and March, your financial institution which granted you the private loan is required to send you a certificate of interest for the loan. 'last year. In the event that the bank (the service provider or any other banking entity and lending institution) fails to provide you with this certificate, you are entitled to request it free of charge. The steps to follow to make the request are generally very simple. Nevertheless, Lica can also assist you if you encounter difficulties with your bank.

Is the tax cut important?

Although all the tax reductions to be paid are appreciable, it is quite natural that you wonder if yours will be substantial or not. In fact, the gain will essentially depend on the situation of each taxpayer according to certain specific criteria. For example, the tax rate, the place of taxation, the family situation and also the amount of interest you pay.

In any case, whether it is substantial or not, you do not lose anything. On the contrary, it will always be a more or less significant reduction which it would be a shame not to take advantage of.

If you wish to know precisely the amount of the potential savings, do not hesitate to contact us to obtain an accurate simulation of the savings you could achieve. An analysis is always free at Lica!

The taxation of private credit compared to leasing

Consider a concrete case: You have to buy a vehicle and you are still hesitating between a loan or a leasing. Basically, leasing seems to have very attractive interest rates. Note, however, that unlike private credit, leasing interest is not deductible from your taxes and therefore will not save you tax.

The point is that leases are seen more as rentals and not loans. And as a rental, you will not be able to enjoy a tax deduction. On the other hand, the taxation of private credit wants you to have the advantage of being the direct owner of your vehicle upon purchase, while having the possibility of deducting the interest paid from your taxes.

You are in control of your decisions with private credit!

When you take out a private loan for the benefit of a leasing, all the decisions concerning your vehicle belong to you. For example, you can choose your insurance coverage, buy or sell your car or even lease it. On the contrary, with a leasing you will be forced to take out collision damage insurance and you will not be able to resell or rent your vehicle as you wish.

Another important point to note: With the credit, you will not have to pay additional costs for exceeding the mileage or in the event of early termination of the contract. Therefore, remember to study each case carefully before making your choice between leasing or private credit.

The solution to enjoy the best in terms of private credit taxation

To be sure to benefit from the best taxation of private credit, use the Lica services. We will take care of the processing of your request in a short time, without obligation and free of charge. You can get a much better rate by selecting the best solution and get your answer in less than 24 hours. In addition, Lica also supports you free of charge on complex issues related to your loans.

Our conclusion on the taxation of private credit

A credit will always remain an additional charge in your budget. However, it is very valuable to take advantage of a competitive loan solution that is also deductible from your taxes.

Unfortunately, many people don't necessarily think about declaring their private loans. Often for lack of knowledge or for fear of making a mistake. It also happens that specialists in the subject, such as a fiduciary for example, simply forget to declare your credit.

If you still have doubts on the subject, our specialized team is always available to answer your questions 7 days a week. Ask us for more information and we will be happy to answer you.