Do you dream of driving in a beautiful brand new car? However, like many people, your budget does not allow you to purchase a vehicle without financing. Moreover, when choosing between a leasing or a loan, you do not necessarily know which is the best solution for you!

To tell the truth, these two financing solutions have advantages and disadvantages. In this new article, we therefore give you the right advice to avoid financial loss. Good reading !

The fundamental differences between leasing and credit?

Leasing:

A leasing contract is actually a rental with an option to buy. It therefore features three players:

- a dealer;

- a leasing company;

- and you !

Contrary to private credit you do not own the car during the lease. You pay a fixed monthly rent to its owner, the leasing company, during the rental period. At the end of the contract, you can buy the used car by paying its residual value. Given how it works, leasing generally offers more advantageous rates than credit.

And the credit:

Private credit is a loan made from a third-party financial institution. Once the funds have been received, you can dispose of them freely and therefore buy the vehicle you want! As a borrower, you must repay the total amount to the credit institution while respecting fixed deadlines. With a private loan, your vehicle belongs to you and you are therefore free to do what you want with it! The interest rate will be higher or lower depending on your situation and the offers obtained.

Which is the cheaper of the two?

If we only refer to numbers, the costs of leasing are significantly lower compared to consumer credit. The explanation is very simple and is only played on lower interest rates with a leasing. Indeed, as the leasing company remains the sole owner of the vehicle, it can afford to have a lower interest rate due to a lower risk of loss of funds.

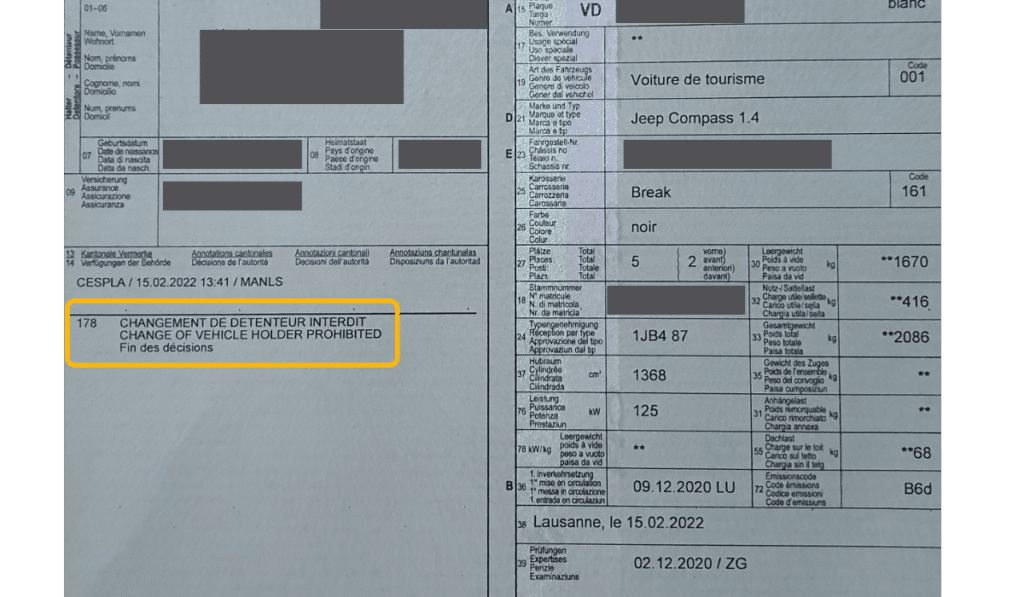

The leasing company will therefore make a pledge on your car by indicating on the circulation permit that it is the owner of the vehicle. This inscription bears the name of the code 178 » and can be the source of different problems as indicated this 20 minute article.

Yes, however private credit offers many advantages!

This is true, and moreover the difference in costs in favor of leasing remains relatively small, especially in comparison with the various advantages of private credit.

- You are the owner of the vehicle, so you can do whatever you want with it. No need to wait or negotiate with the leasing company to part with the vehicle! Nowadays, leasing contracts are often established for a period of 4 years. During this long period, many things could happen that would lead you to have to change your car, for example.

- With a leasing, you must buy back your vehicle at the end of the contract. The leasing offer was very attractive and unfortunately you did not pay attention to the price to be paid at the end of your contract. Depending on the monthly payments calculated and the kilometers travelled, the final purchase price of the vehicle can turn out to be very steep!

- With a private loan, you don't care about the kilometers traveled. And yes, who says leasing, also says that the number of kilometers traveled each year is limited. If you have exceeded your kilometers at the end of your leasing contract, you will have to pay for them. The price per kilometer exceeded can vary from 3 to 12 cents depending on the brands and the conditions of your contract. Assuming an overrun of 30,000 kilometres, the final additional bill could vary from CHF 900.- to 4,500.-.

In summary, credit is therefore a little more expensive but offers you more freedom and more financial security in exchange!

Comparative table of credit or leasing

Here is a table that summarizes the advantages and disadvantages of these two financing solutions.

| The specificities | Leasing | Credit |

|---|---|---|

| Vehicle ownership | The leasing company | It's you ! |

| The kilometers | Limits | Unlimited |

| Resale of the vehicle | Difficult and negotiable | Total freedom |

| Residual value | The vehicle must be redeemed | Does not exist |

| Interest rates | Varies from 0% to 5% | Varies from 3.9% to 9% |

| Tax savings | Interest is non-deductible | Interest is deductible |

| The year of the vehicle | The vehicle must not be more than 5 years old | You are free to choose |

| Deposit upon purchase of the vehicle | You must deposit a deposit | No deposit required |

| Vehicle wear and maintenance | Your vehicle must remain impeccable | You choose! |

| Assurance | Collision insurance is mandatory | No obligation except RC insurance |

Despite the financial appeal of leasing, it still imposes a lot of constraints! The credit is therefore a little more expensive but offers you many more advantages!

Our conclusion to choose between leasing or credit

As you will have noticed, private credit remains more advantageous! However, despite the constraints, leasing can also prove to be interesting in the following cases:

- If you are a company or a self-employed person, the monthly payments will also be deductible;

- In the event that you are absolutely certain not to exceed the kilometers;

- And finally, if you are looking for a new vehicle and a rental perfectly matches your needs.

Otherwise, you will certainly opt for the credit solution to finance your new car! If you currently hold a lease, you should also know that it is always possible to buy back your lease using a loan. This process is free and will save you from having to pay a large sum at the end of your lease.

You can request a non-binding offer and make the comparison!

Lica advises you in a neutral and objective way in your financing questions

Now that you know perfectly the differences between leasing and credit, take the time to ask our specialists to find the best solution. You can always count on Lica which will accompany you in a confidential way in your steps.

Do you have questions before making your request? Our advisers are there to answer your questions 7 days a week directly on WhatsApp. Ask us for more information and we will be happy to answer you!